- (Topic 1)

Which test is used to determine if an employer-employee relationship exists?

Correct Answer:

D

Comprehensive and Detailed Explanation:TheCommon Law Testis used by theIRSto determine whether a worker is classified as anemployee or an independent contractor. The test evaluates factors related to:

✑ Behavioral control(Does the employer control what and how the worker performs

tasks?)

✑ Financial control(Are business expenses reimbursed? Is the worker making an independent profit or loss?)

✑ Type of relationship(Are there benefits like paid time off? Is the relationship expected to be long-term?)

✑ Option A (Time Test)is incorrect because it applies toqualifying earned income for tax benefits, not employment classification.

✑ Option B (Substantial Presence Test)is incorrect because it determinesresident alien tax status.

✑ Option C (Permanent Resident Test)is incorrect because it relates toimmigration status, not employment relationships.

Reference:

IRS Publication 15-A – Employer??s Guide to Worker Classification Payroll.org – Independent Contractor vs. Employee Compliance

- (Topic 2)

Payroll system security violations may result in:

Correct Answer:

B

✑ Unauthorized access (B) is a direct result of security breaches.

✑ Other options (A, C, D) may result from human error but not security violations. References:

✑ Payroll Security Guidelines (Payroll.org)

- (Topic 2)

The purpose of the prenotification process for direct deposit is to ensure that the transaction is:

Correct Answer:

C

✑ Prenotification ensures that the receiving bank (C) accepts and properly routes the direct deposit transaction before funds are sent.

References:

✑ NACHA Direct Deposit Standards

- (Topic 1)

All of the following criteria are used to determine FMLA eligibility EXCEPT the number of:

Correct Answer:

B

Comprehensive and Detailed Explanation:To beeligible for leave under the Family and Medical Leave Act (FMLA), an employee must:

✑ Work for a covered employer (50+ employees) (Option A)

✑ Have worked at least 1,250 hours in the past 12 months (Option C)

✑ Work at a location with at least 50 employees within a 75-mile radius (Option D)

✑ Option B (Number of Dependents) is incorrectbecause FMLA eligibility is based onemployment factors, not personal circumstances.

Reference:

U.S. Department of Labor – Family and Medical Leave Act (FMLA) Eligibility Guidelines Payroll.org – FMLA Compliance Requirements

- (Topic 1)

An exempt employee is being paid an annual discretionary bonus. The employee has submitted a 2020 W-4. Calculate the net pay based on the following information:

Correct Answer:

B

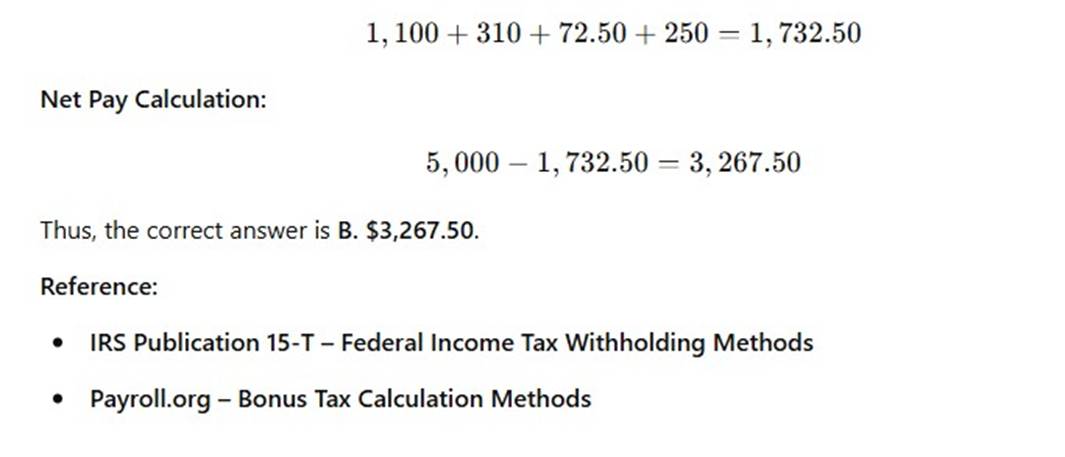

Comprehensive and Detailed Explanation:Using theIRS Supplemental Wage Method, theflat tax rateof22%applies tobonuses:

✑ Federal Income Tax:

✑ Social Security Tax:

✑ Medicare Tax:

✑ State Income Tax: Total Taxes Withheld:

A white paper with black text

AI-generated content may be incorrect.