- (Topic 2)

The lowest priority is given to which of the following time management categories?

Correct Answer:

D

TheEisenhower Matrixis a time management framework that categorizes tasks by urgency and importance:

✑ Urgent & Important: Must be done immediately (e.g., payroll processing).

✑ Not Urgent but Important: Planning and strategic tasks (e.g., compliance training).

✑ Urgent but Not Important: Tasks that may be delegated (e.g., responding to non- critical emails).

✑ Not Urgent & Not Important:These tasks have the lowest priorityas they do not contribute significantly to productivity (e.g., unnecessary meetings).

References:

✑ Eisenhower Matrix Time Management Framework

✑ Payroll Management Best Practices (Payroll.org)

- (Topic 1)

Under the CCPA, use the following information to calculate the MAXIMUM child support order deduction allowed for an employee supporting a second family and in arrears.

Correct Answer:

B

Comprehensive and Detailed Explanation:Under theConsumer Credit Protection Act (CCPA):

✑ If the employeesupports a second family and is in arrears, themaximum

garnishment limitis55% of disposable earnings.

✑ Calculate Disposable Earnings:

✑ Calculate Maximum Child Support Deduction (55% of disposable earnings): Thus, the correct answer isB. $768.90.

Reference:

U.S. Department of Labor – CCPA Garnishment Rules Payroll.org – Child Support Withholding Guidelines

- (Topic 2)

IRS regulations require employers to take all of the following actions for taxable noncash awards EXCEPT:

Correct Answer:

A

✑ Employers are not required to "gross up" (A) taxable awards unless they choose to cover the employee??s tax liability.

✑ The IRS mandates taxation and W-2 reporting (B, C, D).

References:

✑ IRS Publication 15-B

- (Topic 2)

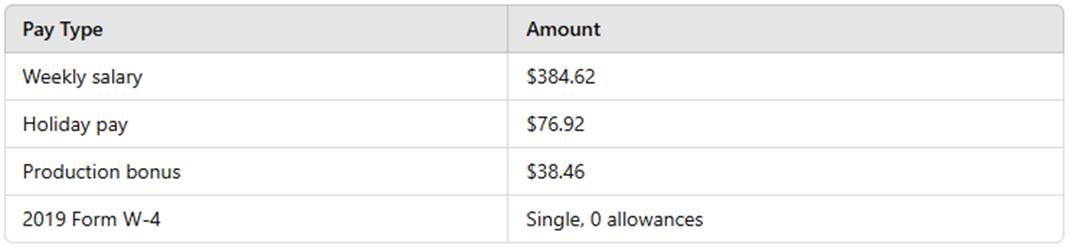

Using the percentage method for automated payroll systems, calculate the federal income tax withholding based on the following information:

Correct Answer:

C

✑ Total taxable wages: $384.62 + $76.92 + $38.46 = $500.00

✑ Using IRS percentage method tables, withholding = $39.04 References:

✑ IRS Publication 15-T (Tax Withholding Tables)

- (Topic 1)

Payroll standard operating procedures should be updated no less frequently than:

Correct Answer:

C

Comprehensive and Detailed Explanation:PayrollStandard Operating Procedures (SOPs)must beregularly updatedto maintain compliance and accuracy.

✑ Best practice is to update SOPs whenever workflows change(Option C).

✑ Option A (Annually)is incorrect becausewaiting a full yearcould lead to outdated procedures.

✑ Option B (Quarterly)is incorrect unless payroll processes are highly dynamic.

✑ Option D (When management changes)is incorrect becauseprocesses may change independently of leadership changes.

Reference:

Payroll.org – Payroll Policies and Procedures Best Practices IRS – Payroll Compliance Guidelines