- (Topic 2)

An independent contractor status is indicated if the worker:

Correct Answer:

C

✑ Independent contractors DO NOT complete Form I-9, as they are not employees underIRCA (Immigration Reform and Control Act).

✑ Employees receiveForm W-2and completeForm W-4.

✑ Independent contractors completeForm W-9for tax reporting. References:

✑ IRS Independent Contractor Guidelines (Publication 1779)

- (Topic 1)

Which of the following amounts is subject to federal income tax withholding?

Correct Answer:

B

Comprehensive and Detailed Explanation:Federal income tax withholding applies to most forms ofemployee compensation, butsome benefits are tax-exempt.

✑ Option A (401(k) Deferral)is incorrect because pre-tax contributions to atraditional

401(k)arenot subject to federal income tax(but are subject to FICA).

✑ Option C (Military Moving Expenses)is incorrect becausequalified military moving expensesare excluded from taxable income under theTax Cuts and Jobs Act (TCJA).

✑ Option D (HSA Contribution)is incorrect becausepre-tax HSA contributionsmade through payroll deductionare tax-exempt.

✑ Option B (Salary Advance) is correctbecause anyadvance on future wagesis treated astaxable compensation when paid, and income tax must be withheld.

Reference:

IRS Publication 15 – Taxable and Non-Taxable Compensation Payroll.org – Payroll Taxable Income Guidelines

- (Topic 1)

Which of the following forms is used to report federal income tax withheld from payments to an independent contractor?

Correct Answer:

D

Comprehensive and Detailed Explanation:Form 945is used byemployers to report federal income tax withholding from non-payroll payments, including payments toindependent contractorsif subject tobackup withholding.

✑ Option A (Form 940)is incorrect becauseForm 940 reports federal unemployment

taxes (FUTA).

✑ Option B (Form 941)is incorrect because it is used foremployee payroll tax reporting.

✑ Option C (Form 944)is incorrect because it is used forsmall employers filing annually.

Reference:

IRS Form 945 Instructions

Payroll.org – Independent Contractor Withholding Rules

- (Topic 2)

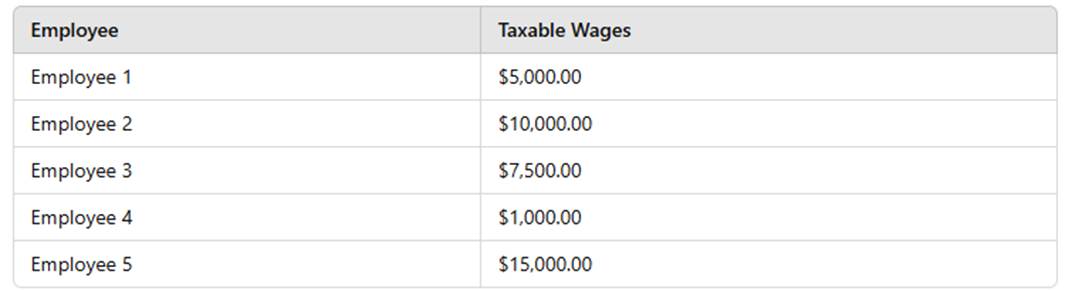

Using the table of taxable wages below, calculate the employer'sFICA tax liabilityon the first check of the year:

Correct Answer:

B

✑ Total Taxable Wages:

✑ Social Security Tax (6.2%)

✑ Medicare Tax (1.45%)

✑ Total FICA Tax (Employer??s share) References:

✑ IRS Publication 15 (Employer??s Tax Guide)

- (Topic 2)

The reconciliation of an employee federal income tax withholding account occurs when which type of account is balanced?

Correct Answer:

D

✑ Payroll taxes withheld from employees are consideredliabilitiesuntil they are remitted to the IRS or state agencies.

✑ Liability accounts track amounts owed, includingfederal income tax, Social Security, and Medicare withholdings.

✑ Expense accounts (C)track company payroll expenses but are not used for withholding reconciliations.

References:

✑ IRS Payroll Accounting Guidelines

✑ Payroll Tax Reconciliation Guide (Payroll.org)